February 19, 2026

Cash Flow Volatility from Equity Pay is common among public company executives. While total compensation may be strong, cash does not always arrive in steady intervals.

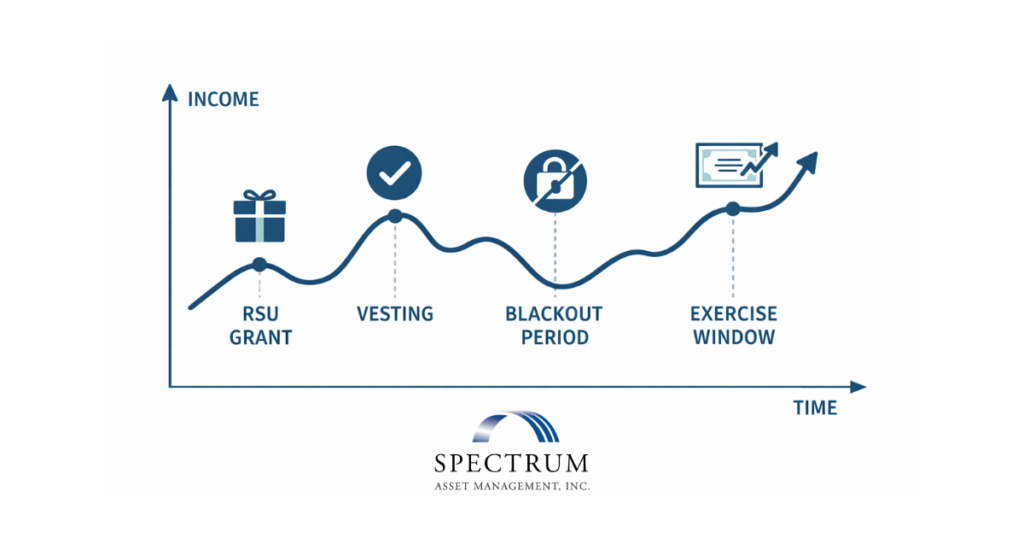

Vesting dates, blackout periods, and market movement can all affect when income becomes usable.

This can create planning challenges, even at high income levels.

Why Income Can Feel Volatile, Even at Higher Levels

Equity compensation often comes in waves. A large vesting event may be followed by months of limited liquidity.

Sources of uneven cash flow can include ESPPs, performance awards, and other long-term incentives. Share prices at the time of sale also affect realized proceeds.

Recipients of equity compensation may experience:

- Income spikes in specific calendar years

- Access to liquidity limited to trading windows

- Higher tax exposure in vesting years

- Gaps between liquidity events

Without proper planning, spending patterns may rise during strong income years, and in weaker years financial obligations may outweigh available cash.

Regulatory and Timing Constraints

For many leaders, insider stock sales must follow strict compliance rules. Trading windows and pre-set plans can limit flexibility.

That means liquidity decisions are not always immediate. Timing requires coordination.

Building a Smoother Framework for Cash Flow

Cash Flow Volatility from Equity Pay does not require perfect forecasting. It just requires structure.

Liquidity & cashflow planning often includes setting reserve targets, separating fixed expenses from variable spending, and modeling multiple income scenarios.

The goal is stability, not precision.

When income is irregular, a disciplined framework can reduce financial stress and support long-term decision-making.

Ready to Take the Next Step? Contact Spectrum Asset Management

Disclaimer: This material is for informational and educational purposes only and should not be construed as investment, legal, or tax advice. All investing involves risk, including the potential loss of principal. Consult your financial, legal, and tax professionals regarding your personal circumstances.